What is the Sharpe Ratio?

- The Sharpe Ratio, developed by Nobel laureate William F. Sharpe, is a measure that evaluates the risk-adjusted return of an investment. It helps investors understand how much excess return they are receiving for the extra volatility endured by holding a riskier asset.

- In the context of mutual funds, the Sharpe Ratio is instrumental in comparing the performance of different funds by adjusting for their risk levels.

How is the Sharpe Ratio Calculated?

The Sharpe Ratio is calculated using the following formula:

Sharpe Ratio=Rp−Rfσp\text{Sharpe Ratio} = \frac{R_p – R_f}{\sigma_p}Sharpe Ratio=σpRp−Rf

Where:

- RpR_pRp = Return of the portfolio (mutual fund)

- RfR_fRf = Risk-free rate (typically the return on government treasury bills)

- σp\sigma_pσp = Standard deviation of the portfolio’s excess return (a measure of risk or volatility)

Example Calculation:

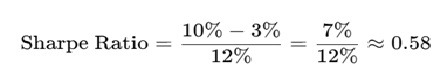

- Suppose a mutual fund returns 10% annually.

- The risk-free rate is 3%.

- The standard deviation (volatility) of the fund’s return is 12%.

Then:

A Sharpe Ratio of 0.58 implies that for every unit of risk, the fund earns 0.58 units of excess return.

Importance of Sharpe Ratio in Mutual Fund Evaluation

1. Measures Risk-Adjusted Performance

- The Sharpe Ratio provides a means to assess the return of an investment compared to its risk. A higher Sharpe Ratio indicates better risk-adjusted performance.

2. Facilitates Comparison Between Funds

- By standardizing returns for risk, investors can compare mutual funds with different volatility levels on a like-for-like basis.

3. Assists in Portfolio Optimization

- Investors aiming to maximize returns while minimizing risk can use the Sharpe Ratio to select funds that offer the best risk-adjusted returns.

4. Identifies Efficient Funds

- Funds with higher Sharpe Ratios are considered more efficient, providing more return per unit of risk.

Interpreting the Sharpe Ratio

- Sharpe Ratio > 1: Acceptable risk-adjusted return.

- Sharpe Ratio > 2: Very good risk-adjusted return.

- Sharpe Ratio > 3: Excellent risk-adjusted return.

- Sharpe Ratio < 1: Sub-optimal risk-adjusted return; the investment may not be adequately compensating for the risk taken.

Limitations of the Sharpe Ratio

- Assumes Returns are Normally Distributed: The Sharpe Ratio presumes that investment returns are normally distributed, which may not always be the case.

- Sensitive to the Time Period Chosen: The ratio can vary significantly depending on the time frame used for analysis.

- May Not Capture All Risks: It primarily considers standard deviation as a measure of risk, potentially overlooking other risk factors.

There is a luminous patience in your writing, allowing understanding to unfold slowly and naturally. The sentences cultivate awareness, encouraging the reader to dwell on meaning, perceive subtle nuances, and experience insight as a gentle, enduring resonance rather than a sudden revelation.

thanks for reading my article