To accumulate ₹1 crore at maturity through a Systematic Investment Plan (SIP), you need to carefully consider three main factors: the monthly SIP amount, the investment duration (number of years), and the expected annual rate of return. The interplay between these factors determines how quickly and efficiently you can reach your ₹1 crore goal. Below is a comprehensive, bullet-pointed guide to help you understand and plan your SIP investment strategy for this target.

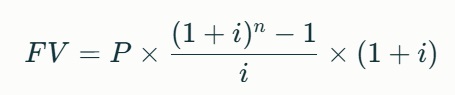

Understanding the SIP Formula

- The SIP maturity amount is calculated using the formula:

-

- FV: Future Value (target corpus, e.g., ₹1 crore)

- P: Monthly SIP amount

- i: Monthly rate of return (annual rate divided by 12)

- n: Total number of SIP installments (months)

- This formula accounts for compounding, as each monthly investment grows for a different period.

Key Steps to Calculate SIP for ₹1 Crore

1. Decide Your Investment Horizon

- The longer you invest, the lower your required monthly SIP.

- Common investment horizons for such targets are 10, 15, 20, or 25 years.

2. Estimate the Expected Rate of Return

- Equity mutual funds have historically delivered 10–15% annualized returns over long periods.

- Conservative estimates use 10–12% per annum.

- Aggressive investors may expect 14–15% or more, but higher returns come with higher risk.

3. Use SIP Calculators for Precise Planning

- Online SIP calculators allow you to input your target amount, expected return, and investment period to instantly get the required monthly SIP amount.

- Alternatively, you can input your planned SIP amount and see how long it will take to reach ₹1 crore.

Sample Scenarios: SIP Amounts and Durations for ₹1 Crore

Scenario 1: 10% Annual Return

- 10 Years

- Required SIP: ~₹43,500 per month

- 15 Years

- Required SIP: ~₹19,800 per month

- 20 Years

- Required SIP: ~₹10,300 per month

- 25 Years

- Required SIP: ~₹5,800 per month

Scenario 2: 12% Annual Return

- 10 Years

- Required SIP: ~₹39,100 per month

- 15 Years

- Required SIP: ~₹17,300 per month

- 20 Years

- Required SIP: ~₹8,900 per month

- 25 Years

- Required SIP: ~₹4,900 per month

Scenario 3: 15% Annual Return

- 10 Years

- Required SIP: ~₹34,100 per month

- 15 Years

- Required SIP: ~₹14,100 per month

- 20 Years

- Required SIP: ~₹7,000 per month

- 25 Years

- Required SIP: ~₹3,600 per month

Values are approximate and may vary slightly with different calculators or compounding conventions.

How to Use an SIP Calculator

- Visit any reputed SIP calculator online.

- Enter your target amount (₹1 crore).

- Input the expected annual rate of return.

- Specify your planned investment duration.

- The calculator will show the required monthly SIP amount.

Factors Affecting Your SIP Journey

1. Rate of Return

- Higher returns: Lower SIP needed, but higher risk.

- Lower returns: Higher SIP needed, but more predictable.

2. Investment Tenure

- Longer tenure: Compounding works in your favor, reducing monthly SIP.

- Shorter tenure: Requires higher monthly SIP to reach the same goal.

3. Regularity and Discipline

- Consistent monthly investments are crucial.

- Missing SIPs can delay your target.

4. Step-Up SIPs

- Increasing your SIP annually (step-up) can help you reach your goal faster or with a lower starting SIP.

Practical Examples

Example 1: 15 Years, 12% Return

- Required SIP: ~₹17,300 per month.

- Total Invested: ₹17,300 × 12 × 15 = ₹31,14,000.

- Wealth Created: ₹1 crore – ₹31,14,000 = ₹68,86,000.

Example 2: 20 Years, 12% Return

- Required SIP: ~₹8,900 per month.

- Total Invested: ₹8,900 × 12 × 20 = ₹21,36,000.

- Wealth Created: ₹1 crore – ₹21,36,000 = ₹78,64,000 (from returns).

Example 3: 25 Years, 12% Return

- Required SIP: ~₹4,900 per month.

- Total Invested: ₹4,900 × 12 × 25 = ₹14,70,000.

- Wealth Created: ₹1 crore – ₹14,70,000 = ₹85,30,000.

Bullet-Pointed Summary Table

| Tenure (Years) | Expected Return | Monthly SIP Needed | Total Invested | Wealth Created (Returns) |

|---|---|---|---|---|

| 10 | 12% | ₹39,100 | ₹4,69,2000 | ₹53,08,000 |

| 15 | 12% | ₹17,300 | ₹31,14,000 | ₹68,86,000 |

| 20 | 12% | ₹8,900 | ₹21,36,000 | ₹78,64,000 |

| 25 | 12% | ₹4,900 | ₹14,70,000 | ₹85,30,000 |

Tips for Achieving ₹1 Crore Corpus

- Start Early: The earlier you start, the more compounding works in your favor.

- Increase SIP Over Time: Step-up SIPs (annual increase) help offset inflation and boost your corpus.

- Stick to Your Plan: Avoid stopping SIPs due to short-term market volatility.

- Review Performance: Monitor your funds and switch if consistently underperforming.

- Reinvest Dividends: Opt for growth plans to maximize compounding.

Conclusion

- The monthly SIP amount and investment duration required to accumulate ₹1 crore depend on your expected rate of return and how long you can stay invested.

- With a 12% annual return:

- ₹39,100/month for 10 years,

- ₹17,300/month for 15 years,

- ₹8,900/month for 20 years,

- ₹4,900/month for 25 years.

- Use online SIP calculators for precise planning.

- Start early, stay disciplined, and review your plan regularly to achieve your ₹1 crore goal.

For the most accurate planning, always use a trusted SIP calculator and consult a financial advisor to tailor your investment strategy to your unique goals and risk tolerance.

x5fzu2